Financial institutions partner with Wildfire to deliver a loyalty rewards program as a financial services product.

The Only Bank-Grade Shopping Rewards Platform

Some of the largest organizations in the world, including banks like RBC, Citi, and Visa, trust Wildfire to enable valuable shopping rewards to their card and account holders. And with good reason.

We go beyond surface-level marketing claims with proven bank-grade features, security certifications, and capabilities that deliver a rewarding customer experience and help the bank become more integrated in customers' everyday lives.

All while meeting the requirements of strict industry regulations and banks’ compliance teams.

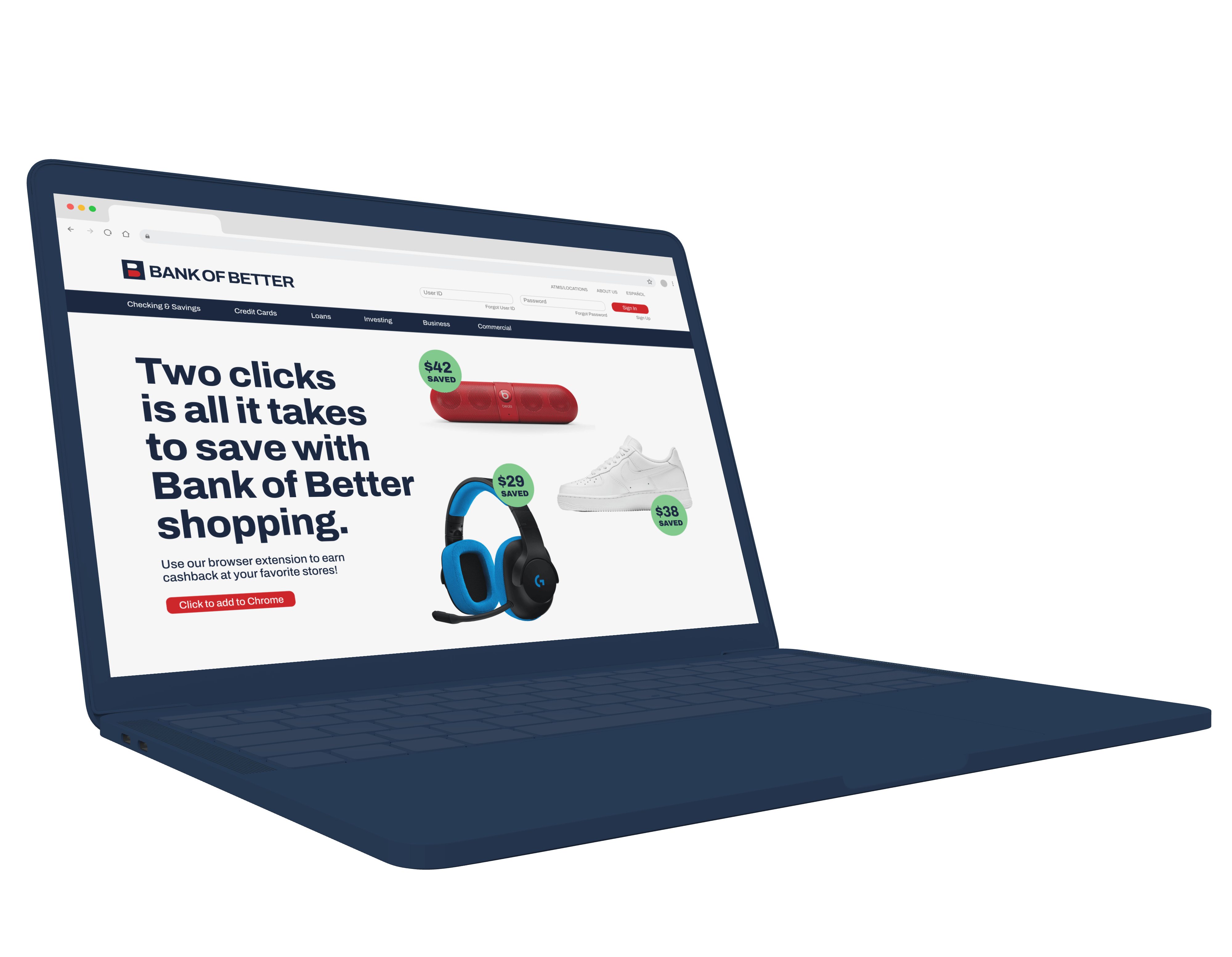

Bank-Centric Features

Every financial services organization has unique needs in terms of the cashback program they wish to offer their clients, data protection and information security, and proprietary integrations. Our bank-grade white-label rewards platform can deliver the specific features you may need, including:

- Custom reporting: To help audit your cashback program for regulatory compliance

- Privacy and security: Tokenized/anonymized user data, PCI-DSS Certification, SOC 2

- Transparency and fairness: Built to uphold UDAAP standards with processes in place to safeguard against violations of guidelines around fair, transparent, and honest practices

A Shopping Rewards Platform You Can Trust

As competition increases and customer retention becomes more challenging, shopping rewards programs are no longer a nice-to-have; they’re a must-have.

Shopping rewards programs are proven to add value for banking customers while delivering incremental revenue for financial institutions. Schedule a meeting to walk through the only rewards platform that meets the strict standards of the banking industry.

Consumers are looking for money-saving tools from their bank

79% of respondents in our 2024 consumer survey would be more likely to install a browser extension for cashback and coupons if offered by their primary bank.

Want to learn more?

Read our blog posts on bank-grade fintech platforms.