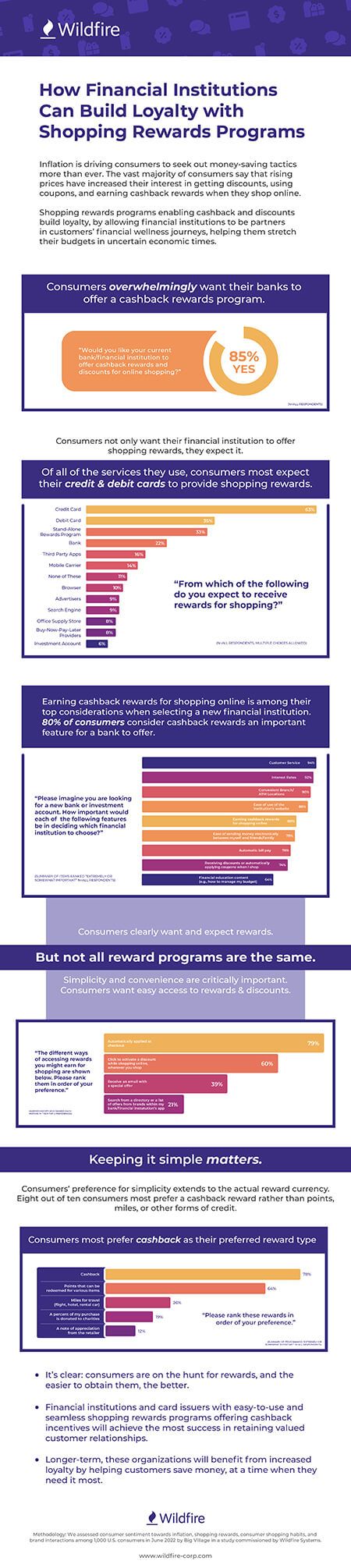

An uncertain economy and rising inflation are driving consumers more than ever to seek out money-saving tactics such as cashback rewards for shopping and coupons. Our recent whitepaper, titled "Online Shopping Rewards Have Gone Mainstream, Offering A Win For Banks, Retailers, And Consumers Alike," quantified consumer attitudes towards these tactics in light of the economic environment: 90% of respondents said that rising prices have increased their interest in getting discounts, using coupons, and earning cashback rewards when they shop.

The report not only reveals the importance and popularity of rewards programs to today's consumer, but also their expectations towards their banks offering such programs.

- 85% want their banks to offer a cashback rewards program

- 80% consider cashback rewards an important feature when choosing a new bank or investment account

- Consumers expect to earn shopping rewards from their cards: 63% expect to earn them from their credit cards, and 35% from their debit cards

- While rewards programs are clearly in demand, simple and convenient programs are by far the most popular, with 79% of customers preferring rewards to be offered seamlessly as they shop

The following infographic based on data from our whitepaper illustrates how banks can deploy easy, consumer-friendly shopping rewards programs to meet growing consumer demand, while also increasing positive monthly brand interactions and ultimately building more brand loyalty. (Click to download the full infographic.)