One way companies, and financial services brands in particular, can convey the benefits of a cashback rewards program for their customers is through the addition of a custom shopping site or offer directory, where the company can house an extensive showcase of coupons and cashback rewards offers from various merchants. This type of a “shopping portal” or “rewards portal” can enhance customers’ experience with a company, making it easy to quickly review and identify the online stores they want to shop from based on the level of reward or discount.

How shopping sites are often done

You’ve probably seen these shopping sites in your own banking or credit card online accounts.

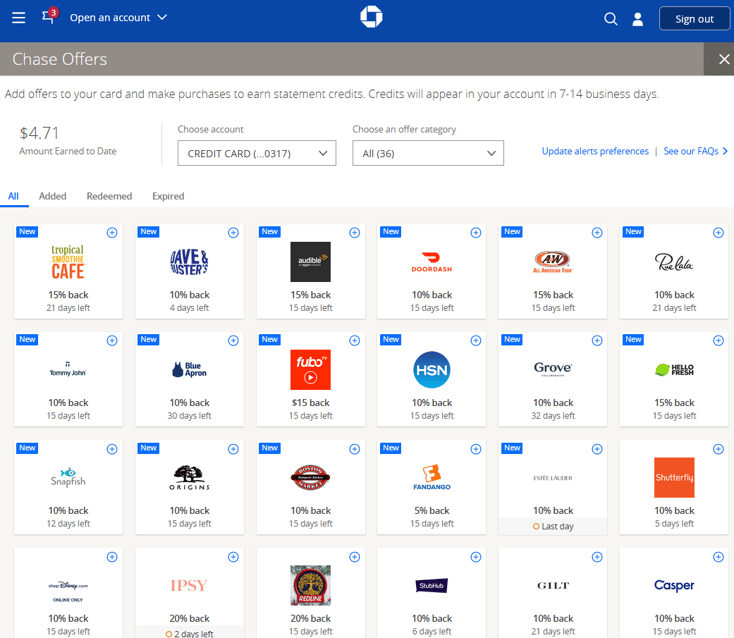

Here’s an example of Chase.com’s Offers page. These offer cashback to the customer when they purchase with their Chase card:

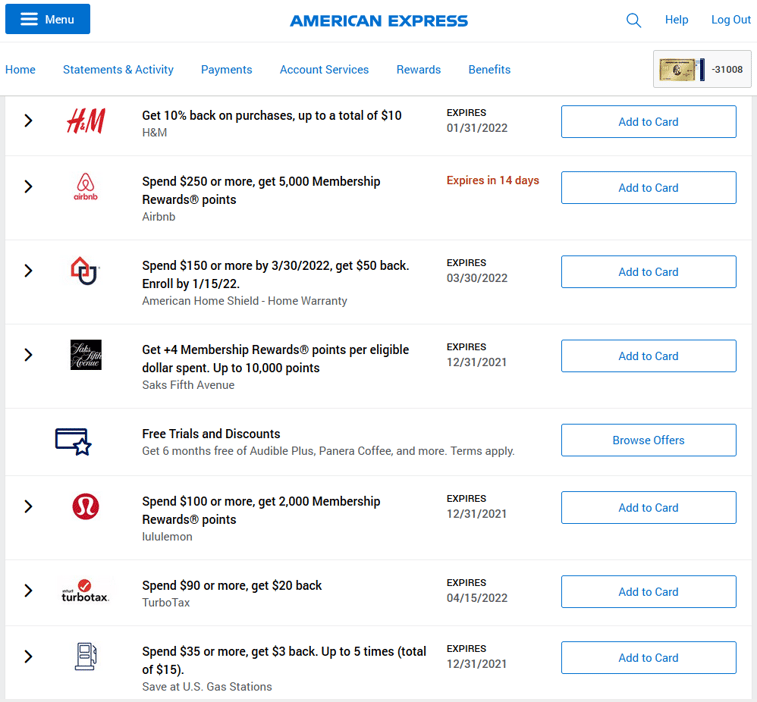

Another way to implement a shopping site is for a credit card provider to show a list of card-linked offers available to their customers. In this scenario, a customer again logs into their online account then sees an “offer wall” of what offers are available to activate and earn rewards for purchasing.

Here’s an American Express card-linked offer directory:

Having a shopping site is a convenient and centralized place for displaying cashback offers or deals. Customers can see every merchant where they can activate a cashback offer, then go shop to earn it.

But, this shouldn’t be the ONLY place a company with a cashback program offers customers a way to activate cashback offers or learn about coupons and deals. This is often the case with card-linked offers or even standalone cashback programs like the one from Chase.

Why this isn’t the best method

While convenient and centralized, shopping sites alone are not the ideal way to share available cashback offers or coupons/deals with customers. Companies who create shopping sites as the sole way to earn additional revenue through merchant-funded commissions from online purchases originating from these sites actually restrict the potential revenue they could earn from those commissions. Why?

Put simply, most customers just don’t shop this way online. If a customer needs a new pair of running shoes, do they really think to themselves, “Oh, let me go to my Amex account, log in, and navigate to the shopping site, then pick a merchant from there so I can get a $10 statement credit” ?

Spoiler alert - no.

They do not do this. A customer will do a Google or Amazon search, or they'll self-refer and go directly to a site because they like a brand already, or they click from a merchant’s promotional email, or maybe even see an influencer’s post and click from there.

There’s a myriad of ways a customer may start their online shopping journey, and it’s frequently not from a shopping site at their bank or credit card online account. In fact, less than 2% of people who view a card-linked offer in a shopping site actually redeem it.

The user experience is typically lacking, too. Many shopping sites nowadays rely on the customer to remember this sequence in order to access cashback offers:

- Remember the shopping site actually exists

- Go to their online bank or card account

- Log in

- Visit the shopping portal

- Click to activate an offer

- Finally, remember to use the preferred payment tender at checkout!

Is it any wonder these offers see sub-2% redemption rates?

The modern approach to a shopping / rewards portal

Instead, the modern approach to having a shopping site or rewards directory is for it to complement a company’s other cashback/rewards offerings. Companies should think of a cashback loyalty rewards program as just that - a program with multiple features and corresponding benefits for customers.

So, don’t only consider a shopping site with a wall of offers to share cashback opportunities. Instead, provide customers a variety of smart shopping tools that enhance customers' online shopping experience.

The shopping site can be a centralized launchpad. If the customer is already in their online account area or visits it from external marketing, they can visit to see if any offers interest them.

Then, supplement a custom shopping site with complementary tools such as a browser extension that notifies customers of coupons/deals and cashback opportunities in-the-moment while shopping, or provide automatically-generated referral links that help them earn money for recommending products to others.

These types of features increase the customers’ opportunities to earn cashback (and, opportunities for the company to earn commissions too), plus they reflect the natural flow of how customers shop, compared to the 6+ steps for a card-linked offer as described above.

With a multi-faceted cashback rewards loyalty program, a company can create multiple opportunities to be seen, with repeated positive connotations for the company as a helpful shopping companion which provides easy access to deals & cashback.

This helps to create a virtuous cycle for customers. They earn the cashback each time they shop, seeing the brand as the conduit providing these benefits, so they keep shopping, and keep earning. In effect, the company behind these tools becomes a natural part of customers’ shopping experience, and receives the positive association as a halo effect.