At October’s Money20/20 USA event in Las Vegas, I met with 26 banks and other financial services companies. Do you know what ALL of them said?

Literally all of the consumer-facing financial institutions (FIs) I met with said that their strategy for 2023 and beyond was to shift from being a “back office” utility to being a “consumer-centric” function, and the key to all of their plans is “customer engagement.”

This comes as no surprise, as financial service businesses of all sizes and types are working to overcome challenges with their digital transformation efforts and customer engagement projects.

When I asked how they plan to go about increasing engagement, my contacts’ answers all included deploying products that improve their customers’ financial lives.

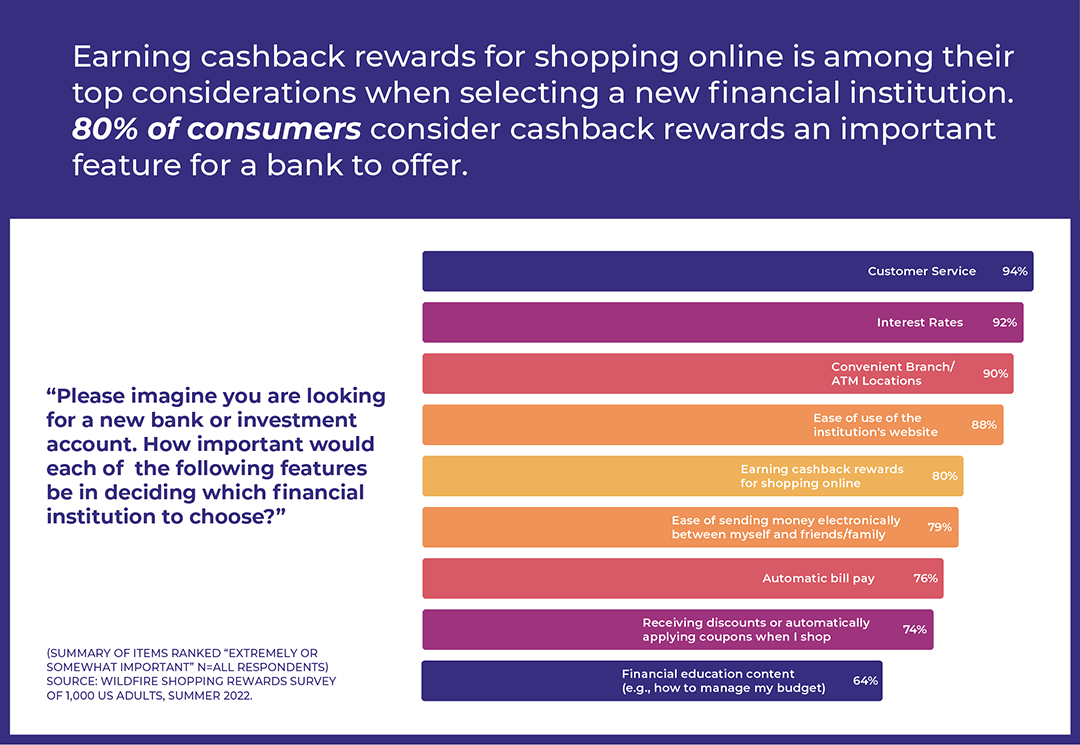

In a survey commissioned by Wildfire and conducted by the research firm Big Village, we examined consumers' attitudes and expectations towards tactics like coupons and shopping rewards, and in line with what the banks were telling me, the data reflected parallel consumer demand for ways to improve their financial well-being.

Among other things, the results revealed that 90% of consumers agreed that concern about a tightening economy is driving increased interest in using coupons, getting discounts, and earning cashback rewards for shopping.

It makes sense - when times are good, people don’t mind saving money, but when times are bad, they absolutely seek out opportunities to do so. Even in a contracting economy, consumers still need to buy things, and if they can save even a little money with discounts or cashback rewards while they do their necessary shopping, all the better.

Simplicity and Convenience is Key for Rewards Programs

Importantly though, consumers also require the convenience of seamless integration with their bank of choice: Rather than having those incentives and shopping rewards siloed in yet another company’s offering, consumers overwhelmingly prefer it to be part of their trusted primary financial institution.

Indeed, the data showed that 80% of consumers consider a cashback rewards program to be an important feature when choosing a new bank, and 1 in 4 people said they would switch, or have switched, banks based on the availability of such a program.

Given these findings, for banks that are considering rewards programs, it’s also critical to note the importance of a program being easy-to-use. Consumers are busy, and simplicity is an absolute must. They just won’t participate in a difficult program that involves multiple convoluted steps, even when the product they are using is literally giving them free money.

There are plenty of non-consumer-centric, complicated rewards programs out there. As proof, the data showed that nearly half of the respondents said they did already participate in some sort of rewards program from their bank. However, 38% of those consumers had never even received any rewards! Why? 63% of those people indicated they had some sort of confusion about the programs.

Why The Time is Right for Shopping Rewards

There seems to be a perfect storm of events that are evolving the need for financial institutions’ loyalty and cashback rewards programs from a nice-to-have offering, to a must-have cornerstone product to drive engagement, retention, and revenue.

- First, money-saving programs like coupons and cashback rewards are in high demand. This is due in part to the evolving familiarity with shopping rewards programs over the years. But the phenomenon is also being accelerated by consumers’ economic anxiety.

- Second, the entire financial services industry is in the middle of a paradigm shift from “back office” functions to more “consumer-centric,” engaging products that also help customers stretch their dollars further. Banks must demonstrate with their product offerings that they are in the customers’ corner and are actively helping them with financial wellness.

- Third, shopping rewards programs have improved since the last round of innovation in the space. The technology has evolved to a place that cashback rewards products are now truly revolutionary compared to what has been in the market in years past.

Card-linked offers, for instance, as a loyalty and rewards tactic employed by some FIs, simply do not drive meaningful engagement online. Instead, FIs now have the opportunity to bring their loyalty programs up to date and offer a cashback rewards product that can help consumers in their day-to-day lives, at the perfect time when they are demanding it.